A new AI-powered feature lets users track

everything from gold and collectables to cars and crypto, in one dashboard by

simply uploading a photo or screenshot.

Bangalore, August 20, 2025 : Fi Money, India’s leading AI-powered money management

platform, today announced the launch of Magic Lens, a

category-first feature that allows users to instantly add overlooked assets to

their net worth. With a simple photo or screenshot, Magic Lens leverages

advanced AI to identify and value everything from gold jewelry and collectables

to cryptocurrency, ESOPs, and vehicles, giving users a comprehensive and true

picture of their net worth.

This innovative feature fills a major gap in personal

finance. While traditional apps focus on bank accounts and mutual funds, they

often overlook a large part of an individual’s wealth, such as physical or

non-traditional assets. Magic Lens achieves this by creating a single, unified

financial dashboard where users can view and manage their entire portfolio.

“At Fi Money, we’ve always believed that managing

your wealth should feel effortless. Yet for many, a financial dashboard still

shows only part of the story. Magic Lens changes that, letting you capture and

value everything from family gold and a classic watch to ESOPs and crypto

holdings, all in one secure view. It’s about recognising that what you truly

own goes beyond bank balances and investments, and giving you the clarity to see

it all together,” said Sujith Narayanan, Co-Founder of Fi Money.

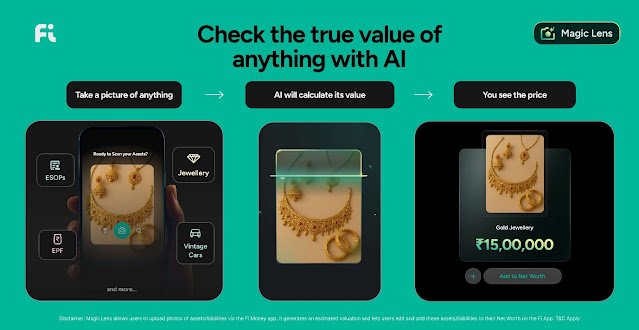

How Magic Lens Works

Magic Lens makes tracking these assets simple and

intuitive:

- Snap

or Upload: Users take a photo or

screenshot of any asset. - Identify

and Value: The AI instantly identifies

the asset and provides an estimated value, factoring in depreciation based

on its condition and age. - Approve

and Add: Users can edit or approve the

value before adding it to their net worth.

The launch of Magic Lens follows Fi’s recent

successful launch of the MCP Server, a protocol that connects consolidated

financial data to AI tools like ChatGPT and Gemini for smarter financial

conversations. By integrating new wealth-building assets, Fi is creating a

“one-home-for-everything” financial experience that bridges the gap

between how people build wealth today and how they track it.

Users retain full control over their data, with the

ability to edit, delete, and manually update asset values at any time. This

ensures accuracy and gives users full transparency and control over their

entire financial dashboard.

About Fi Money

Fi Money is an integrated financial services platform

that helps users Save, Pay, Track, Invest and Borrow from a single app. Fi

provides a range of products in partnership with Federal Bank and other

regulated entities to provide new-age financial features for its users. These

features range from Saving Accounts & Instant Loans to US Stock investments

& Credit Cards. Founded in 2019, the Bangalore-based fintech company is the

brainchild of Sujith Narayanan & Sumit Gwalani, ex-Googlers who pioneered

GPay in India as Tez.

Learn more at: https://fi.money